For months now, experts have been sounding the alarm. There is growing concern worldwide about the severe shortage of raw materials. Now it is the turn of magnesium and aluminium, which have experienced a significant rise.

The alert has been issued by the European aluminium PE industry associations Eurofer, ACEA, Eurometaux, IndustriALL, ECCA, Estal, IMA, EUWA, EUROALLIAGES, CLEPA and Metal Packaging Europe. Together they have made an urgent appeal in view of the imminent risk of production stoppages across Europe as a result of the critical shortage in the supply of magnesium from China.

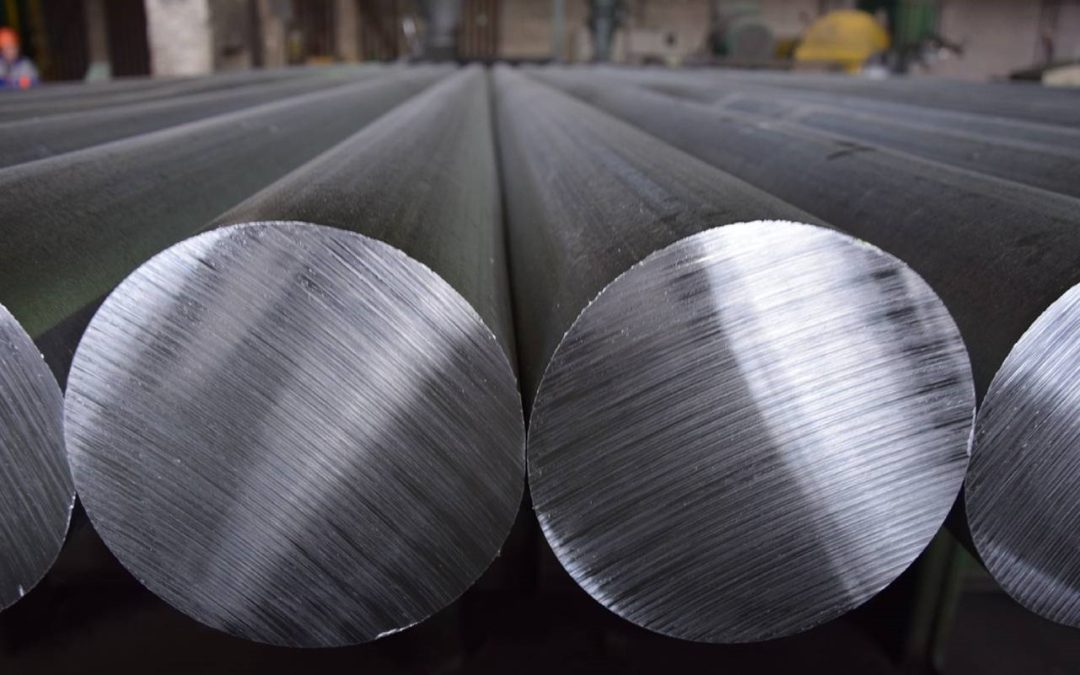

Few people know that magnesium is a key alloying material and is widely used in the metal production industry. Since last September, this supply has been stopped or drastically reduced, causing an unprecedented international crisis.

Although it is surprising, the European Union is almost totally dependent on China in many matters, almost 95% of magnesium is supplied by the red dragon, the European industries of production and use of aluminum, iron and steel, along with their suppliers of raw materials, are being particularly affected as is the case of the automotive, construction or packaging.

Add to this record prices and global imbalances in the supply chain. Remaining magnesium imports are currently priced at stratospheric prices of $10,000 to $14,000 per megatonne, up from $2,000 per megatonne earlier this year, making it almost impossible for European companies to viably produce and source magnesium-containing materials.

WV Metalle, the German non-ferrous metals trade association, has also warned that Europe could run out of magnesium stocks by the end of November, which would mean a reduction in production, a chain of company closures and consequent job losses. Without urgent action by the European Union, this problem, if left unresolved, would threaten thousands of businesses across Europe, as well as their supply chains and the millions of jobs that depend on them.

These associations are calling on the EU Commission and national governments to work urgently on immediate action with their Chinese partners to mitigate the critical shortage problem immediately, as well as the long-term supply effects.

In industry, magnesium is an essential component for the manufacture of aluminium or titanium sheets, but it is difficult to preserve because it shows signs of oxidation after three months. Europe imports 45% of all the magnesium produced in China and 95% of what it needs. There are no substitutes for magnesium in aluminium production, which is also in short supply, and whose reserves have halved since March.

The Old Continent is in a delicate situation in terms of storage and its total dependence on China is already taking its toll. The consequences could be even greater if Europe does not take urgent action now.