In 2025, the international tinplate market is dominated by China, which accounts for 39% of global capacity and sets export prices, while the United States, the European Union, and other countries apply tariffs and anti-dumping measures to protect their industries.

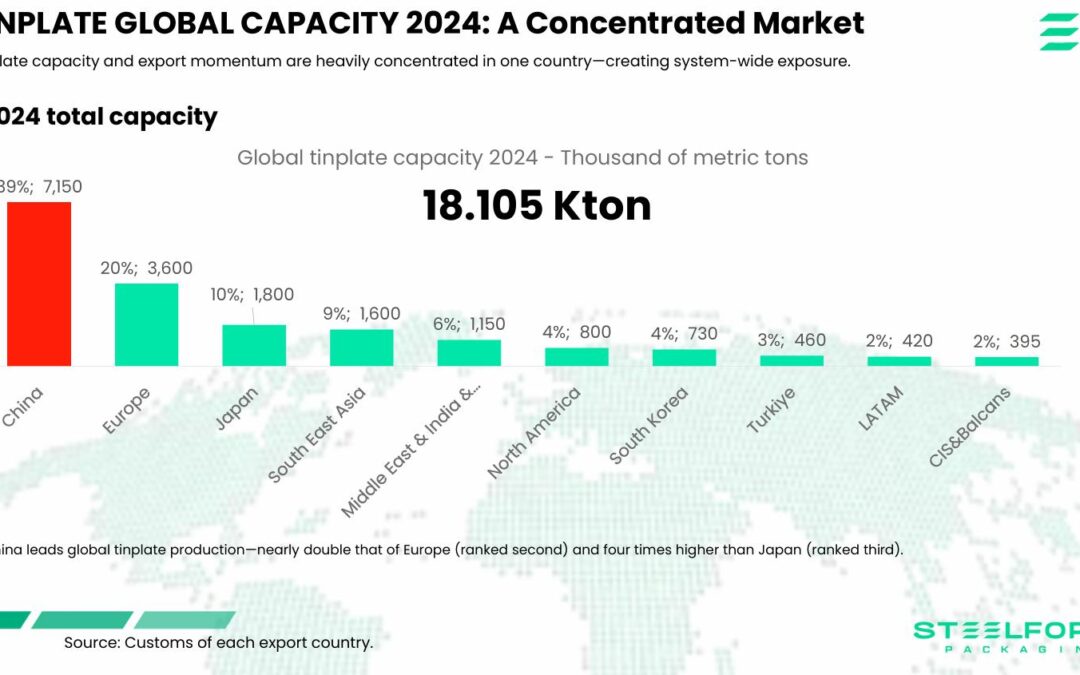

Global production capacity reached 18.1 million tons in 2024, with China producing 7.15 million, almost double that of Europe and four times that of Japan. Between January and May 2025, 82% of the global increase in exports came from China, consolidating its position as the main global supplier.

Import trade totaled 5.43 million tons, led by Europe (38%), followed by North America (25%) and Asia (24%). China has maintained competitive export prices, while tariffs and trade defense measures in the U.S., EU, and other markets attempt to balance competition.

With the entry of the CBAM (Carbon Border Adjustment Mechanism)—a carbon border adjustment mechanism promoted by the European Union—in 2026, which will require carbon emission certificates, producers will have to adapt to a double pressure: traditional tariffs and environmental costs, favoring those who operate with less environmental impact.