The United States is falling dangerously behind in the race to secure the key materials of the future, and the consequences are beginning to show. The International Monetary Fund recently lowered its global and U.S. economic forecasts, citing trade tensions and tariffs as key factors in the economic slowdown. This is according to expert Annie Sartor, director of the Aluminum Campaign at Industrious Labs (an organization dedicated to reducing industrial emissions and promoting sustainable solutions in key sectors such as aluminum and steel). These statements were recently published in Fortune magazine.

This warning underscores the vulnerability of the U.S. economy due to its high dependence on increasingly fragile global supply chains.

One of the clearest examples of this situation is aluminum, an essential metal for sectors such as energy, transportation, construction, packaging, and defense. Despite its growing demand, domestic production capacity has fallen sharply. While there were 23 foundries in operation in 2000, today only four are operational, and none at full capacity.

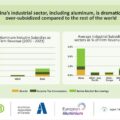

According to a report by Industrious Labs, domestic demand for primary aluminum is estimated to increase by up to 40% by 2035. Currently, 82% of the aluminum consumed in the U.S. is imported—more than half comes from Canada—making the country the largest net importer of this material. However, this supply may not be guaranteed in the long term due to changes in the global market and new trade regulations in Europe.

If this trend continues, the U.S. could face a critical shortage of aluminum in the coming years. The report projects a need for up to 6.4 million metric tons per year by 2035, a figure far exceeding current capacity. This shortage would directly affect the prices of key products such as automobiles, electrical cables, packaging, and components for clean energy.

To avoid this crisis, it would be urgent to reactivate inactive foundries, increase production in existing facilities, and invest in new plants, something that has not been done in more than four decades. Projects such as the new foundry proposed by Century Aluminum or the reopening of plants such as Hawesville and Magnitude 7 Metals could recover up to half a million metric tons of capacity and generate nearly a thousand jobs.

Beyond supply, it is about ensuring the country’s industrial competitiveness and resilience. With a combined strategy of public and private investment, a smart industrial policy, and a commitment to modernization, the U.S. can regain leadership in the aluminum sector and ensure a more solid and sustainable economic future. Otherwise, it risks losing not only market share but also its ability to respond to the challenges of the 21st century.