A new report from the Organisation for Economic Co-operation and Development (OECD), “Quantifying the Role of State-Owned Enterprises in Industrial Subsidies.”finds that industrial subsidies, such as below-market financing, tend to increase the degree of state ownership.

The consequence is that there is a distortion of global aluminum and other markets.

The report also notes that state-owned enterprises are more likely to benefit from favorable application of competition rules, government procurement practices and forced technology transfers.

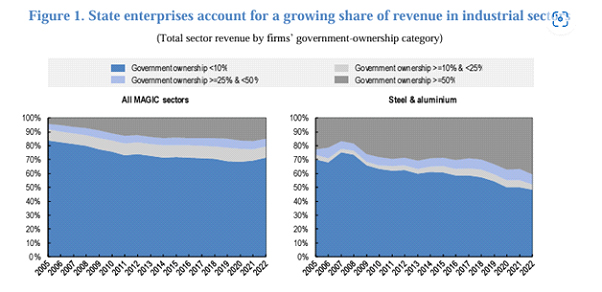

The report details that. “The growing weight of [las empresas estatales] is especially visible in heavy industries such as steel and aluminum, where companies with 25% or more government ownership generated nearly half of all revenues among the companies sampled in 2022.”

Charles Johnson, president and CEO of the Aluminum Association; Paul Voss, general manager of Aluminium Europe; Jean Simard, president and CEO of the Aluminum Association of Canada; and Yasushi Noto, executive director of the Aluminum Association of Japan have shown their unanimous support to governments and international organizations to prevent unfair competition from such stateization.

“Until there is a globally level playing field and fair competition in aluminum markets, we urge governments to implement trade defense measures to enable the survival of our otherwise competitive industrial base.”, say aluminum officials.

They add that on behalf of member companies and the 1.75 million workers they support directly and indirectly in the United States, Europe, Canada and Japan, they are committed to working with governments and international organizations to ensure the production of “responsible and sustainable” aluminum .

China

The proportion of aluminum and steel companies by revenue with significant government ownership has grown at a faster rate than other sectors analyzed over the past two decades.

This growth has been driven especially by companies headquartered in China.

The new research highlights the role of state-owned enterprises (SOEs) as important recipients of industrial subsidies and as major providers of such support.

The analysis found that below-market provision of energy inputs by state-owned enterprises is common in some energy-rich countries, while below-market financing by state-owned banks is a widespread subsidy instrument in China.

This is an important new insight for governments seeking to level the playing field and ensure fair competition globally.