1Analysis by region. Market of metal cans for food and beverages.

South America

South America is expected to contribute significantly to the growth of metal cans market

for food and beverages. Several dairy products are exported from South American countries to developed regions. Therefore, the demand for metal cans in the region is expected to grow. The increased consumption of alcoholic beverages such as wine, beer and cocktails has strengthened the market for metal cans in the region. Increasing economic growth in countries such as Argentina and Brazil has led to high demand for canned food and beverages. This has led to the growth in demand for metal cans for food and beverages for longer shelf life and to maintain the taste and nutritional value of the products.

The South American region defined for this study includes Brazil, Argentina and the rest of South America. The Rest of South America region includes countries such as Peru, Colombia and Venezuela. Moreover, the recycling benefits and eco-friendly nature of aluminum in South American countries have offered potential growth for the metal cans market.

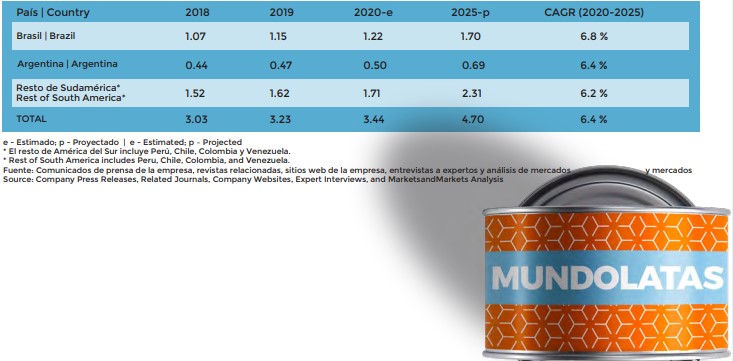

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

In the South America region, Brazil dominated the market by value and volume in 2018. The market in Brazil is projected to grow at the highest CAGR in terms of value during the forecast period. The country is among the leading producers of canned food and beverages in the South American region; therefore, the demand for metal food and beverage containers is expected to be high over the next few years.

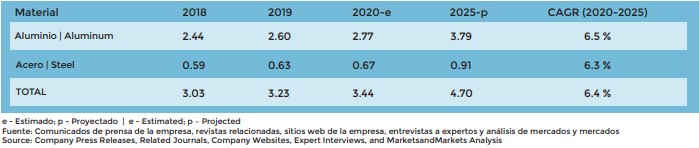

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY MATERIAL, 2018-2025 (USD BILLION)

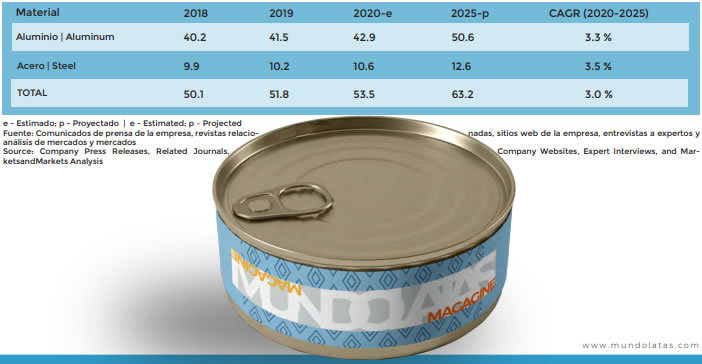

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY MATERIAL, 2018-2025 (MILLION UNITS)

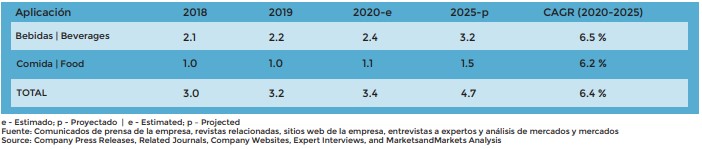

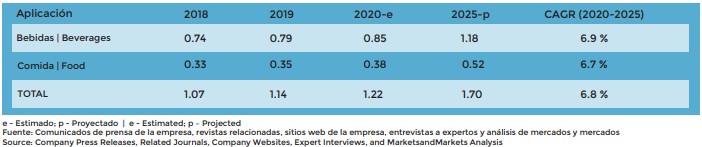

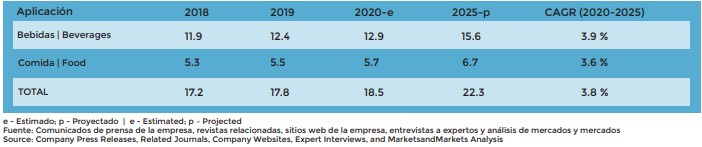

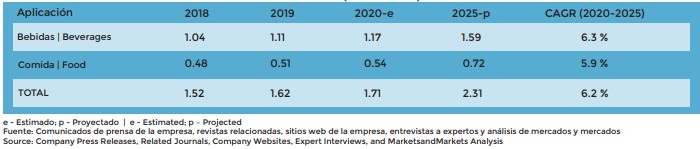

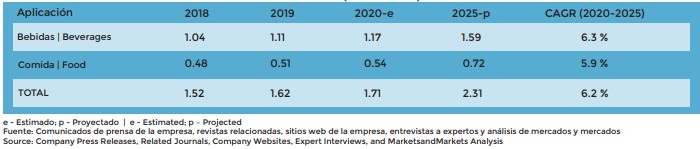

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

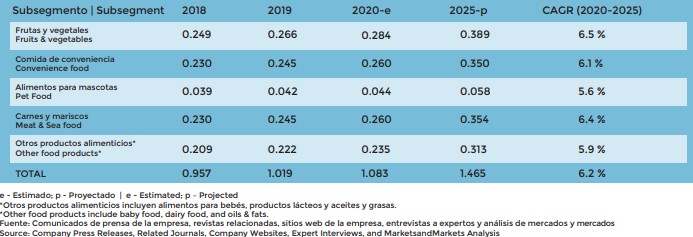

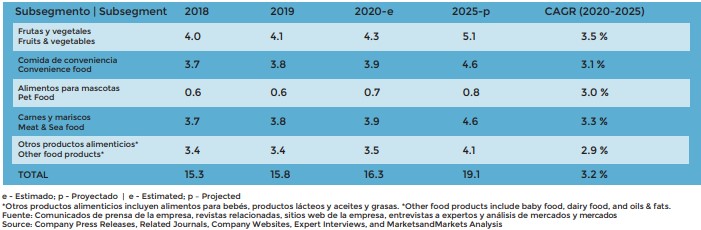

SOUTH AMERICA: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLION)

SOUTH AMERICA: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

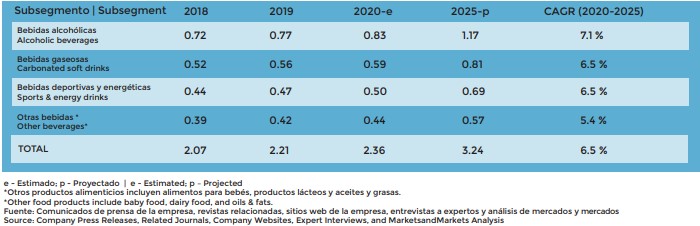

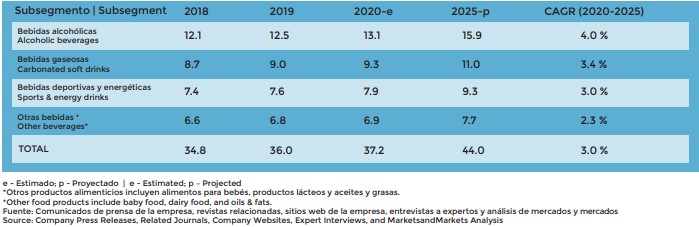

SOUTH AMERICA: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLION)

SOUTH AMERICA: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

On the basis of material, aluminum dominated the market in 2018 in terms of value and volume. Aluminum is projected to experience significant growth at a compound annual growth rate of 6.5% in value terms in the South American region, due to its high production and export of aluminum and aluminum-based cans throughout the country and around the world.

On the basis of application, the beverages segment has dominated the market. It is expected to grow significantly in the South American market, due to the growing consumption of alcoholic beverages such as wine and beer, which require metal packaging to maintain their taste and quality.

Brazil

HIGH DEMAND FOR PACKAGED FOOD DRIVES METAL PACKAGING MARKET

Brazil is one of the fastest growing economies in South America. Brazil is one of the leading countries in the production of canned food and beverages. It is among the fastest growing economies in the South American region. Increased production and consumption of canned food and beverages has driven the growth of the economy. It is the largest and most populous country in South America. Brazil’s food manufacturing segment contributes approximately 10% of the country’s GDP and accounts for 15% of employment in the overall industrial sector.

In addition, an increase in the growing economy has led to a considerable demand for packaged food in the country, thereby increasing the demand for metal cans. Busy work lifestyles and consumer preferences for ready-to-eat products have enhanced the growth of canned foods. Therefore, the growth prospects of the metal food & beverage cans market are expected to be favorable during the forecast period.

BRAZIL: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

BRAZIL: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

The beverage segment plays a crucial role in the Brazilian market. This segment is projected to experience significant growth in value and volume during the forecast period in Brazil, due to increased consumer awareness of healthy, nutritional and energy drinks. In addition, the demand for packaged beverages is driving the metal beverage cans market in the country.

Argentina

RISING EXPORTS OF PACKAGED FOOD AND BEVERAGES FUELS GROWTH IN THE METAL PACKAGING MARKET

Argentina is one of the main producers of packaged food and beverages. An increase in the developing economic conditions in Argentina has created a potential for the growth of the metal cans market. Most of the processed food products manufactured in Argentina are used for domestic consumption; therefore, it is important to extend their shelf life by using appropriate packaging, which drives the market for metal cans. The country’s main export markets for processed foods include the United States, Russia and Brazil. Therefore, domestic consumption of packaged food has augmented the growth of the metal cans market. Therefore, it is important to maintain the taste and nutritional value of the products. Metal can production is expected to grow significantly in the future for beverage cans. This has led to the potential of the metal cans market for food and beverages in Argentina.

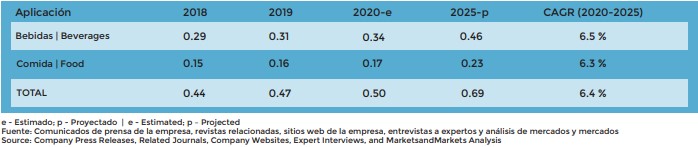

ARGENTINA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

ARGENTINA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

In terms of application, the beverage segment is projected to grow at higher CAGRs of 6.3% and 4.0%, by value and volume, respectively, during the forecast period; this is due to the high domestic consumption of carbonated beverages in the country. The food segment is also expected to grow at a fair pace, owing to high export of processed food to countries such as the US, Russia and Brazil.

Rest of South America

The countries of the rest of South America considered for the purpose of this study are Peru, Colombia and Venezuela. The shift in consumer trends towards processed food and beverages in these countries is driving the metal packaging market. Metal containers play a fundamental role in the food preservation process. Therefore, the demand for convenience packaging from the aforementioned countries will drive metal food and beverage packaging. The canned food & beverages market is expected to witness considerable growth during the forecast period in these countries.

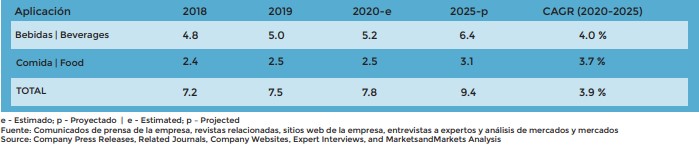

REST OF SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018- 2025 (USD BILLION)

REST OF SOUTH AMERICA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-

2025 (BILLION UNITS)

The growth in the food and beverage segment in countries such as Peru, Colombia and Venezuela makes it a potential market for metal cans. The beverages segment held a significant share of the market, by application. This progress is attributed to the growing demand for carbonated, non-carbonated, sports and energy drinks.

0 Comments