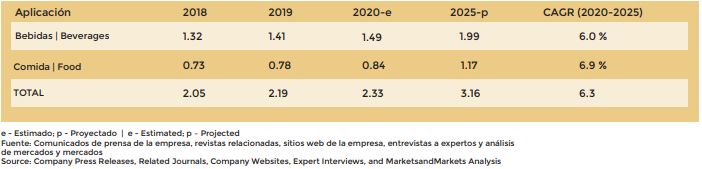

BY REGION – EUROPE AND RUSSIA. Market of metal cans for food and beverages.

Global Forecast to 2025.

EUROPE AND RUSSIA

Europe is one of the leading regions, noted for the consumption of different types of beverages. The metal food and beverage cans market is expected to witness robust growth in the European region during the forecast period. Countries such as Spain, France, the United Kingdom and Italy are among the main producers of beverages. The European metal food and beverage cans market is driven by the high consumption of alcoholic beverages such as beer.

According to the European Commission, the food and beverage industry is the largest revenue-generating industry in the region. France, Germany, Italy, the UK and Spain are the largest food and beverage producers in terms of turnover. According to the World Health Organization (WHO), approximately 70% of adults in Europe consume alcohol. Europeans therefore consume 10.7 litres of alcohol per person per year. Therefore, convenient beverage packaging is important for consumer interest. Aluminium and steel are the most commonly used raw materials for the manufacture of metal cans. These raw materials are recyclable. In addition, due to their ductile property, they can be moulded into different shapes and sizes. Profitability and benefits of aluminum and steel recycling will drive the metal cans market in this region.

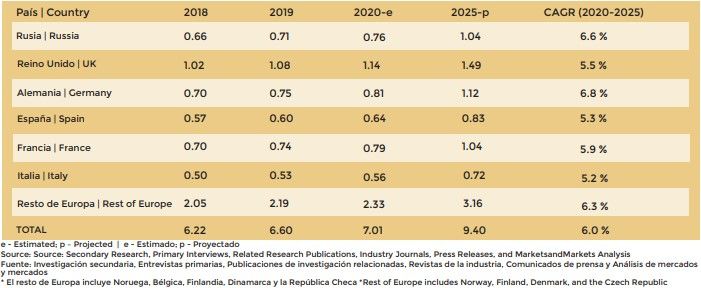

EUROPE: FOOD AND BEVERAGE METAL CANS MARKET SIZE BY COUNTRY, 2018-2025 (USD BILLION)

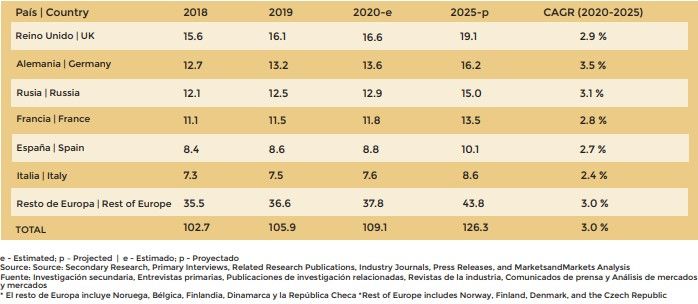

EUROPE: METAL FOOD AND BEVERAGE CANS MARKET SIZE BY COUNTRY, 2018-2025 (MILLION UNITS)

The UK dominated the global food and beverage market in 2018. It is projected to grow at a compound annual growth rate of 5.5% and 2.9% in terms of value and volume, respectively, during the forecast period, as the country is the leading producer of different types of beverages and preserves in the European region. Hence, owing to increased consumption of food & beverages and boosting the market for metal cans for food & beverages.

EUROPE: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY MATERIAL, 2018-2025 (USD BILLION)

EUROPE: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY MATERIAL, 2018-2025 (MILLION UNITS)

EUROPE: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

EUROPE: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

EUROPE: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLION)

EUROPE: METAL FOOD CANS MARKET SIZE BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

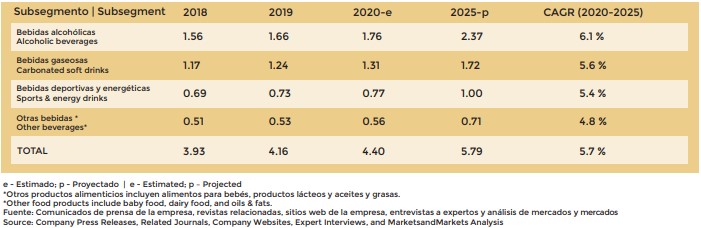

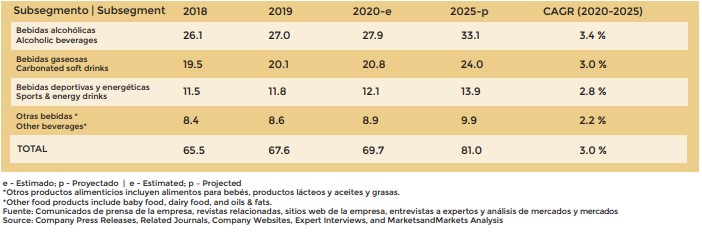

EUROPE: METAL BEVERAGE CANS MARKET SIZE BY SUB-SEGMENT, 2018-2025 (USD BILLION)

EUROPE: METAL BEVERAGE CANS MARKET SIZE BY SUB-SEGMENT, 2018-2025 (USD BILLION)

The beverages segment, by application, dominated the metal food and beverage cans market in Europe in 2018, owing to the large production and export of different types of beverages. This growth is driven by consumers’ rising disposable incomes and busy working lifestyles. On the basis of material, steel, the metal cans segment is projected to grow at a CAGR of over 6.5% in value terms during the forecast period, as processed foods and fresh-cut fruits and vegetables are packaged in steel cans. In addition, changing consumer trends towards ready-to-eat food habits.

RUSSIA

Growing consumer interest in different types of beverages boosts metal packaging market in Russia

Russia is expected to contribute significantly to the growth of the food & beverage metal cans market. The country is among the potential markets in the European region. Many companies are expanding their reach to serve the vast Russian market by setting up new plants to meet the growing demand for beverage cans. People in Russia prefer mainly fruit juices and alcoholic beverages. Increasing sales of soft drinks; new beverage categories such as herbal drinks, juices and iced teas; and the introduction of new energy drinks are some of the main drivers of the Russian beverage can market. This growing demand for different types of beverages in the country has led to the effective production of metal cans, thus contributing to the growth of the metal cans market.

RUSSIA: METAL CANS FOR FOOD AND BEVERAGES MARKET SIZE, BY APPLICATION, 2018-2025 (MIL.

MILLION)

RUSSIA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

The beverages segment dominated the metal food and beverage cans market in 2018, owing to rising demand for beverages and a plethora of offerings from leading companies. In addition, setting up of new manufacturing plants in the country will boost the metal beverage containers market in the country.

UNITED KINGDOM

Global export of 2.2% of food and beverages controls the country’s metal packaging market

The UK is among the largest manufacturers of food and beverages in the European region. The country’s food and beverage sector is considered the largest manufacturing sector, generating USD 36.83 billion in revenue per year, according to the Food and Beverage Federation (FDF). Therefore, consumer demand for canned food and beverages is growing in the country. In addition, changing consumer preferences and demand for a wide range of quality, safe, and nutritious products will drive the market for metal cans. In 2017, the UK accounted for 2.2% of the global food and drink export market, according to the Food and Drink Federation (FDF) in 2017. Most of the UK’s 50% of food and drink is exported to European Union (EU) counties. Therefore, packaging is a very important factor for the export of these products to protect their shelf life, taste and texture. Therefore, the metal food and beverage cans market is expected to grow significantly in the country.

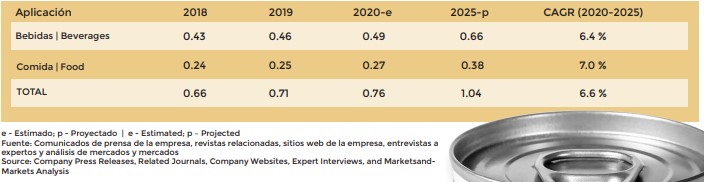

UNITED KINGDOM: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

UNITED KINGDOM: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

In terms of application, the food segment is projected to grow at a compound annual growth rate of over 6.6%, in value, during the forecast period, due to consumer demand for safe and nutritious products. In terms of market share, the beverage segment was the largest in the country.

GERMANY

The significant trend away from plastic and glass packaging towards metal packaging

Germany is one of the largest food and beverage markets in the European region, leading to further growth of the metal can market. According to FDF, Germany exports approximately 5.6% of the world’s food and drink every year. In addition, the upward trend for metal packaging in Germany has increased due to the advantages of metal over plastic and glass packaging. The country is among the largest producers of fresh fruits, such as apples and kiwis. In addition, changing consumer trends and awareness about healthy lifestyles tend to increase the consumption of fruit juices, which fuels the demand for metal cans for packaging beverages such as beer and fruit juices. The dynamic change in consumer preferences has changed the market scenario.

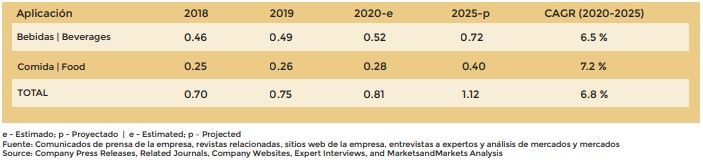

GERMANY: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (THOUSAND)

MILLION)

GERMANY: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (THOUSAND) MILLION UNITS)

According to FDF, the country’s large export of food and beverages is driving the metal cans market in the country. As a result, the beverages segment occupied a significant share in Germany in 2018, and the food segment is projected to grow at a higher CAGR in terms of value over the forecast period.

SPAIN

HIGH DEMAND FROM PROCESSED FOOD INDUSTRY DRIVES METAL CAN PRODUCTION

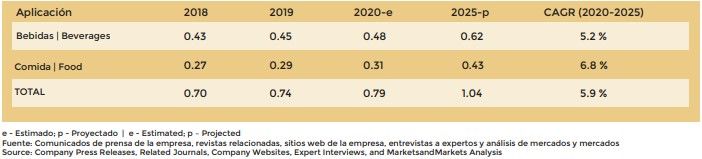

SPAIN: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

SPAIN: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

On the basis of application, the food segment is projected to grow at a higher CAGR in terms of value over the forecast period, as the demand for processed food is increasing in the country. Moreover, changing consumer lifestyle and health related awareness regarding metal packaging will drive the food segment market in the country.

ITALY

EXPORT OF PROCESSED FOOD WILL INCREASE THE MARKET FOR METAL CANS

Italy is one of the key food and beverage markets among European countries. The country has a significant export trade with countries such as Germany, the United Kingdom, France, the Netherlands and Poland. Vegetables grown in the country are used for processed foods. Therefore, the need for canned food is increasing in the region. This increased growth has driven the demand for metal cans market in the country, as it would improve the shelf life of different types of canned food and beverages. The metal cans market in the country is mainly driven by the consumption of beverages such as alcohol, fruit juices, coffee and tea.

ITALY: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

ITALY: FOOD AND BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

The food segment is projected to grow at a compound annual growth rate of over 6.0% in value terms during the forecast period, due to the export of processed food to different countries around the world. In addition, processed foods packaged in steel cans provide better shelf life and quality products, thereby boosting the food market in the country. Moreover, in terms of market share, the beverage segment dominated the metal food and beverage cans market in Italy in 2018.

FRANCE

INCREASING EXPORTS OF FOOD AND BEVERAGES TO EU COUNTRIES DRIVES THE CAN MARKET

France is considered to be one of the potential markets for canned food and beverages in the European region, due to the changing consumption trends of ready-to-go meal habits. The country is an outstanding wine producer. Therefore, it is necessary to preserve the product and increase its shelf life to maintain the taste and texture. Hence, the beverage industry contributes to the significant growth of the metal can market in the country. According to FDF, France exports approximately 4.7% of the world’s food and beverages each year. Moreover, services provided by major players such as Ball Corporation and Crown Holdings in the country is one of the factors driving the metal cans market.

FRANCE: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

FRANCE: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

The wine industry is developing in France, which is supporting the metal packaging market. As a result, in the country, the beverages segment dominated the market in 2018. The metal packaging maintains the quality of the wine for longer and reduces logistical losses.

REST OF EUROPE

The rest of Europe, considered for the study, includes countries such as Norway, Finland, Denmark and the Czech Republic. The metal food & beverage cans market will witness steady growth in these countries during the forecast period. Norway accounted for the highest consumption of energy drinks. These drinks are mainly consumed by children and adolescents. Norway has therefore contributed to the growth of beverages in the region. Finland accounts for the highest consumption of carbonated beverages. He has seen an upward trend in beverage production. In Denmark, due to consumer preferences for healthy lifestyles, the wellness trend continues to drive the market for healthier low-sugar beverages. Therefore, the need for metal cans has a substantial scope in the countries mentioned above.

REST OF EUROPE: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

REST OF EUROPE: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNITS)

Growth in the food and beverage segment in countries such as Norway, Finland, Denmark and the Czech Republic makes it a potential market for metal cans. The beverages segment occupied a major share of the market in 2018. This is attributed to the growing demand for energy drinks and also changing consumer preferences for nutritional drinks.

pedido de pressupuesto

lata para 30g

frutos secos

para venta em vending machine

whatsapp 00351 912 523 461 Vicente