Crown Holdings, Inc. has announced its financial results for the third quarter of 2025, highlighting a significant increase in profitability driven by the demand for beverage cans in Europe.

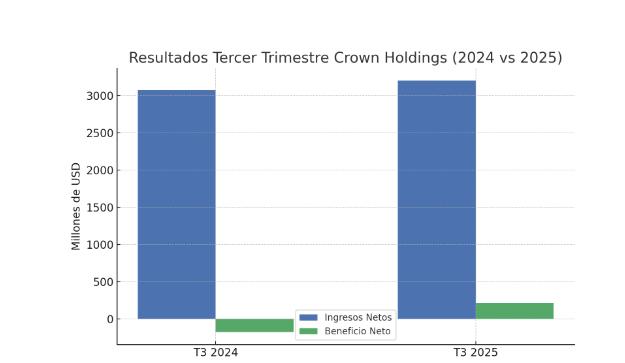

In the three months ended September 30, the company reported net revenue of $3,202 million, compared to $3,074 million in the same period of 2024, driven by a 12% growth in European shipment volume, the transfer of $104 million in material costs, and a positive exchange rate effect of $34 million.

The net profit attributable to Crown Holdings reached $214 million, compared to a loss of $175 million in 2024. The diluted earnings per share was $1.85, while the adjusted figure stood at $2.24, a 13% increase compared to the $1.99 of the previous year.

Regarding revenue by segment, the European beverage segment grew 27% in operating income, while the Americas and Asia-Pacific showed mixed results. Revenues from the American beverage segment reached $1,417 million, and Asia-Pacific added $259 million. Other segments, such as transit packaging and food cans, also contributed to total revenue.

In the accumulated first nine months of 2025, the company recorded $9,238 million in net sales, with a net profit attributable to the company of $588 million, compared to $66 million in the same period of 2024. The adjusted diluted earnings per share rose to $6.05, compared to $4.82 in 2024.

Crown Holdings also highlighted the return of more than $400 million to shareholders through buybacks and dividends, as well as the fulfillment of its long-term adjusted net leverage target of 2.5x.

For the close of 2025, the company raised its adjusted earnings per share forecast to a range of $7.70–$7.80 and expects to generate approximately $1,000 million in adjusted free cash flow, after capital investments of around $400 million.

Timothy J. Donahue, Chairman and CEO, has highlighted that “the strong performance in Europe offset the weakness observed in Asia and Latin America, allowing for global growth in the beverage segment.” For his part, Kevin C. Clothier, CFO, has pointed out that “the results allow us to increase the annual guidance and maintain a solid balance sheet, with returning cash to shareholders as a priority.”