CANPACK Group closed the third quarter of 2025 with higher sales and a 3% increase in beverage can volume, although its operating profit decreased due to increased costs and a higher level of investments.

The multinational aluminum packaging company reported that volumes grew in the U.S. and India, while Europe recorded a decrease that partially offset those advances. In the first nine months of the year, the accumulated volume increased by 2%.

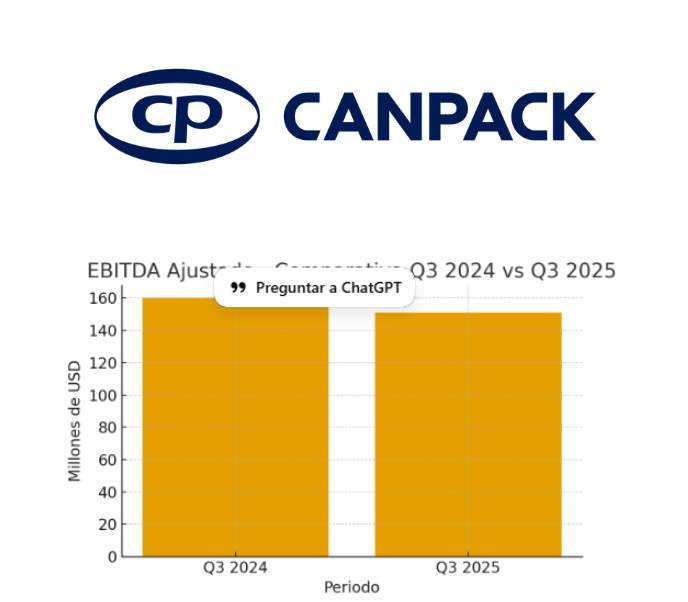

In financial terms, net sales rebounded 9% both in the quarter and in the annual accumulated, driven by the transfer of higher aluminum prices and by firmer demand. However, the adjusted EBITDA fell to 151 million dollars (160 million a year earlier) and to 433 million in the nine months (compared to 469 million in 2024), pressured by higher labor and conversion costs, an increase in logistics spending in India and contractual adjustments linked to inflation.

The company intensified its investment pace, with capex of 47 million dollars in the quarter and 155 million so far this year, destined for capacity expansion and maintenance. The free cash flow registered an outflow of 71 million in the quarter (compared to an inflow of 151 million in 2024), although the annual balance improves with 121 million of inflow.

The CEO of CANPACK, Marius Croitoru, highlighted the company’s resilience and also thanked the teams for their dedication and stressed that the company is “building the future of CANPACK.”