Metal beverage cans have experienced notable growth in the beverage packaging sector, being recognized for their practicality, sustainability, and premium appeal. This success raises the question of whether aluminum bottles could capitalize on this trend and help expand metal packaging to other consumption occasions less suitable for cans.

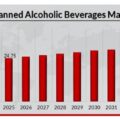

Beverage cans remain highly popular, with a steady increase in sales from 2018 to 2023. This growth accelerated during the pandemic and has continued to benefit from at-home consumption trends, in addition to capturing a larger market share compared to glass bottles, especially in alcoholic beverages.

Despite beer and soft drinks dominating volumes, cans have also been associated with fast-growing categories such as ready-to-drink (RTD) alcoholic beverages, which has consolidated their image as a modern and attractive option. Additionally, recyclability has been highlighted as a key feature of sustainable packaging, valued by a high percentage of consumers.

Aluminum cans are popular for their portability and convenience, especially for individual portions, as well as their low weight and infinite recyclability. However, the recycling rate varies significantly between countries, with some markets, such as the United States, recycling less than half of the cans used.

In recent years, interest in aluminum bottles has been growing, especially in categories such as water and canned wine, albeit from a low base. Aluminum bottles offer advantages such as easily resealable closures, making them more suitable for beverages that are not consumed immediately, like water.

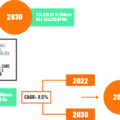

Although metal bottles have been the second fastest-growing packaging type between 2018 and 2023, with a compound annual growth of 12%, they still face challenges, such as their premium price compared to PET, which hinders their acceptance, especially in an uncertain economic context.

In the beverage sector, brands like Diageo and Rémy Cointreau are experimenting with aluminum bottles for spirits and ready-to-drink cocktails, reflecting a growing interest in exploring new packaging types, especially for innovative beverages. In more traditional categories, such as wine and spirits, reducing carbon footprint is driving the use of lighter packaging and alternative materials, with aluminum bottles as a promising option.

The transition towards the use of aluminum bottles will require clear and convincing communication about their sustainability to overcome concerns about consumer perception. Although aluminum bottles currently represent only about 1% of the global beverage market, packaging diversification will continue to grow as brands seek ways to reduce their environmental impact and differentiate themselves in the market.

This diversification process is in its early stages, but aluminum bottles have a solid foundation to face the challenges and take advantage of the opportunities that arise.