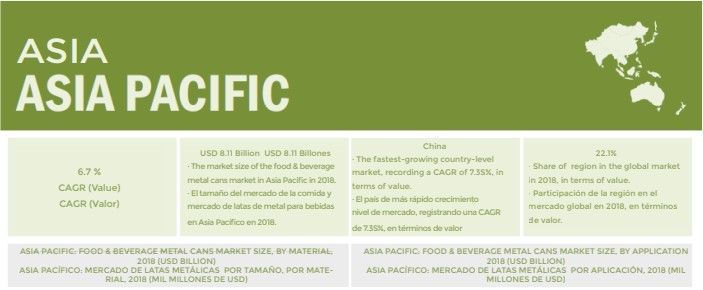

ASIA PACIFIC – Food & Beverage Metal Cans Market BY REGION

Global Forecast to 2025.

ASIA PACIFIC

Asia Pacific accounted for the largest growth in the global food & beverage metal cans market during the forecast period. Countries such as China and India have contributed significantly to the growth of the metal food & beverage cans market in the Asia Pacific region. These countries have a high population density and are the main producers of fruit and vegetables. These factors are projected to drive demand for processed foods and beverages in the region.

Asia Pacific is considered one of the emerging regions for the metal food and beverage cans market. Countries like China, India, Japan, Thailand, Indonesia, Australia and New Zealand are considered for the purpose of the study. Therefore, the market growth is expected to be high in this region. Many types of packaging are preferred in the region, such as flexible, rigid plastic, paper, glass and metal containers. The demand of the food and beverage industry is growing due to the increasing population. Global players such as Ball Corporation (USA) and Crown Holdings Inc (USA) are entering the Asia Pacific market by developing new manufacturing plants in the region. This led to a boom in the market for metal food and beverage cans. High industrial growth, urbanization, environmental concerns, high disposable incomes, and lower production of fresh food & beverages are driving the growth of processed food & beverages, which fuels the demand for metal cans in this sector. In addition, high growth trends towards attractive and safe food packaging will drive the metal cans market in Asia Pacific.

Asia Pacific accounted for the largest growth in the global food & beverage metal cans market during the forecast period. Countries such as China and India have contributed significantly to the growth of the metal food & beverage cans market in the Asia Pacific region. These countries have a high population density and are the main producers of fruit and vegetables. These factors are projected to drive demand for processed foods and beverages in the region.

Asia Pacific is considered one of the emerging regions for the metal food and beverage cans market. Countries like China, India, Japan, Thailand, Indonesia, Australia and New Zealand are considered for the purpose of the study. Therefore, the market growth is expected to be high in this region. Many types of packaging are preferred in the region, such as flexible, rigid plastic, paper, glass and metal containers. The demand of the food and beverage industry is growing due to the increasing population. Global players such as Ball Corporation (USA) and Crown Holdings Inc (USA) are entering the Asia Pacific market by developing new manufacturing plants in the region. This led to a boom in the market for metal food and beverage cans. High industrial growth, urbanization, environmental concerns, high disposable incomes, and lower production of fresh food & beverages are driving the growth of processed food & beverages, which fuels the demand for metal cans in this sector. In addition, high growth trends towards attractive and safe food packaging will drive the metal cans market in Asia Pacific.

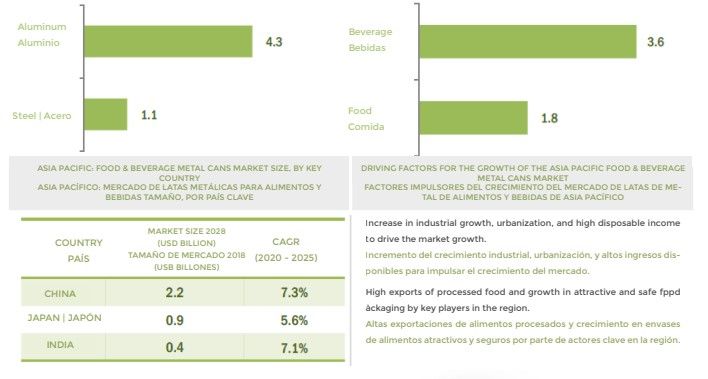

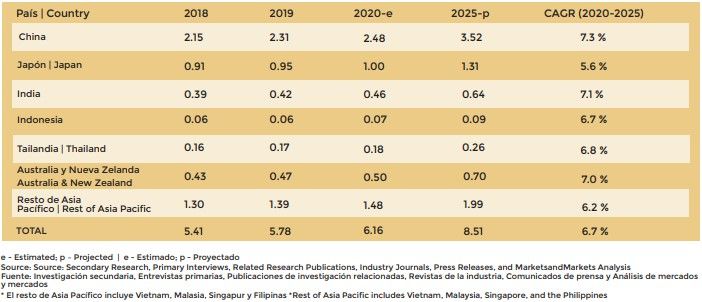

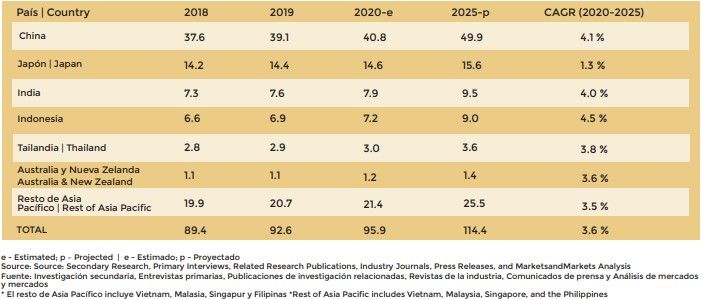

ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY COUNTRY/REGION, 2018-2025 (USD BILLION)

ASIA PACIFIC: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY COUNTRY/REGION, 2018-2025 (BILLION UNITS)

China is projected to grow at the highest compound annual growth rate of 7.3% during the forecast period, due to increasing demand for fresh-cut fruits and vegetables from developed regions. In addition, the country is engaged in high export business of processed food, which drives the metal cans market in the country.

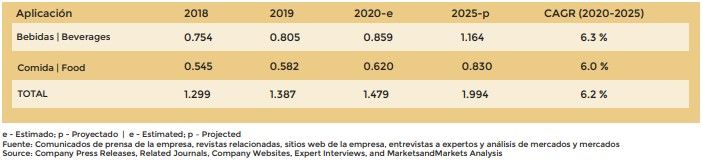

ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY MATERIAL, 2018-2025 (USD BILLION)

ASIA PACIFIC: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY MATERIAL, 2018-2025 (BILLION UNITS)

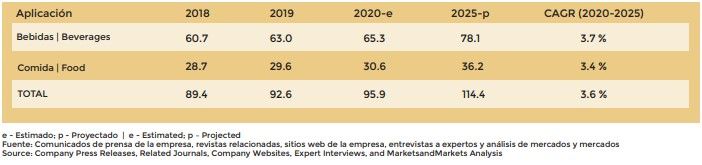

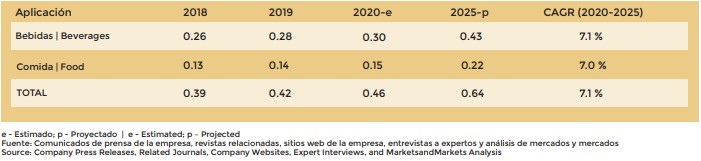

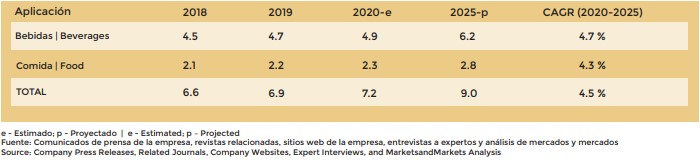

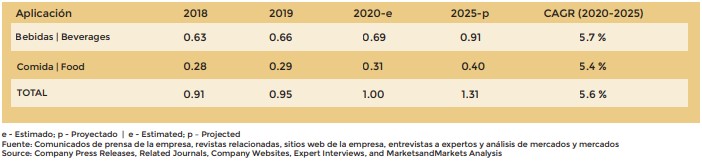

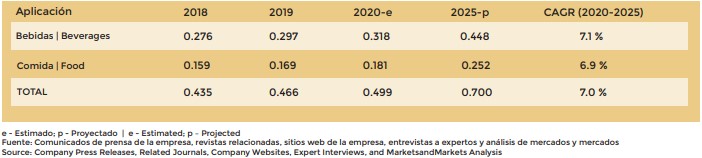

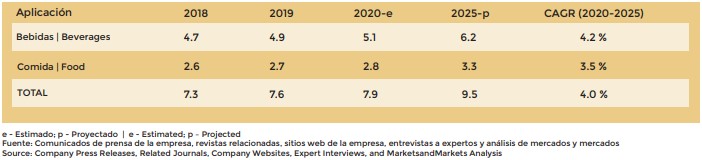

ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

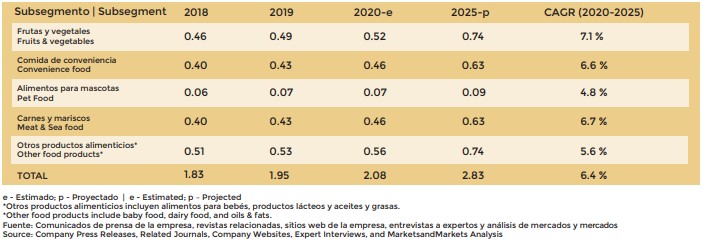

ASIA PACIFIC: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLION)

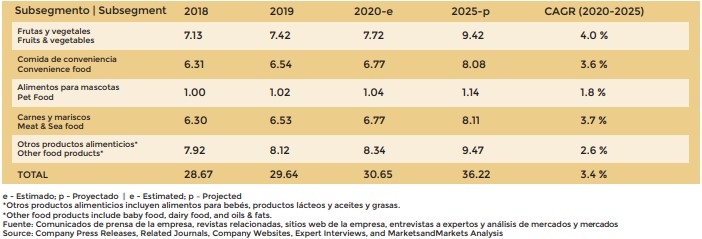

ASIA PACIFIC: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

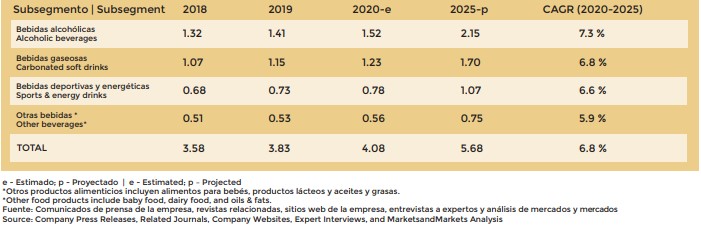

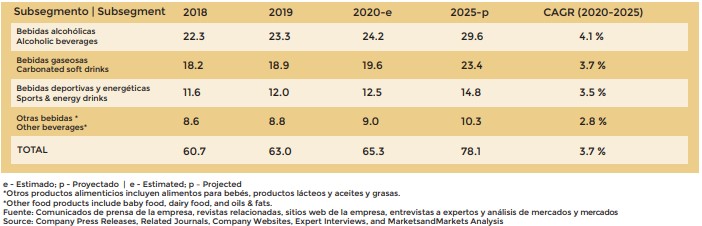

ASIA PACIFIC: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLION)

ASIA PACIFIC: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

In terms of material, according to the main respondents, aluminium is mainly used for beverage packaging, as the material is very ductile and can be moulded into different shapes and sizes. In addition, the reasonable cost of aluminum in the Asia Pacific region is estimated to grow significantly during the forecast period. In terms of application, beverages occupy a significant share due to changing consumption trends and growing urbanization in the Asia Pacific region.

CHINA

The growing demand for canned food in the international market, encourages the production of metal containers in the country.

In the Asia Pacific region, China accounted for the largest market share in the food & beverage metal cans market. Sufficient production of fruits and vegetables has helped key players in China to expand their export trading facilities for processed food and beverages. Therefore, with the increasing need to maintain quality and extend the shelf life of food and beverages, manufacturers in the country have effectively adopted advanced coating and printing technologies for the production of metal cans.

China is among the high-income countries in Asia Pacific and has been able to successfully adopt metal cans to minimize food and beverage waste. People in the country are increasingly preferring canned foods due to their working lifestyles. Therefore, the increasing use of metal cans is anticipated to contribute to the growth of the metal food and beverage cans market. The growth of related industries, such as the food processing industry, has also led to an increase in the demand for metal cans. The growth of the metal cans market has been driven by the increasing consumption of alcoholic beverages. Another factor supporting growth is the rising disposable incomes and spending levels of people in China. Alternatively, China is referred to as the manufacturing hub of all industries, and the same is true for metal cans in the food and beverage industry. The country is capable of producing beverage containers at very low cost.

CHINA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

CHINA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

In the food & beverage metal cans market, by application, the beverage segment dominated by value and volume in 2018. In addition, the beverages segment is growing significantly during the forecast period at respective CAGRs of 7.4% and 4.2% by value and volume, due to growth in consumer consumption of alcoholic beverages.

INDIA

Growing population and rising incomes drive the metal packaging market

India is a densely populated country in the Asia Pacific region. The country is projected to contribute significantly to the growth of the metal food and beverage cans market in Asia Pacific. The country’s main focus is on sustainable and environmentally friendly packaging solutions. The high population growth rate creates an opportunity for manufacturers. In this way, manufacturers create innovative and convenient can packaging for consumers, making the product available in different sizes and shapes. Globalization and the free movement of goods are increasing. Therefore, food packaging requires a longer shelf life, together with food safety and quality control according to international standards.

However, key players in the private sector are focusing on addressing the challenges of sustainable packaging by investing heavily in the development of metal cans. Awareness among Indian consumers about the health benefits is driving the carbonated beverage packaging market.

INDIA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

INDIA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

India is one of the leading producers and exporters of fruits; the country’s export trading facilities for fresh-cut fruits and vegetables are growing; therefore, packaging of food and beverages is a major concern to maintain their shelf life and taste. Therefore, the potential for adoption of metal cans in the country is high; Moreover, the beverages segment dominated the market in 2018, owing to growing disposable incomes, consumer preferences are shifting towards canned carbonated beverages.

JAPAN

Japanese government focuses on promoting the production of flexible and sustainable packaging to foster market growth in Japan

Japan is a developed, high-income country in the Asia Pacific region. Japan metal cans market growth in the food & beverage industry is anticipated to remain high during the forecast period. To maintain the quality and increase the shelf life of fresh food and beverages, manufacturers in the county are using efficient packaging solutions, which are anticipated to contribute to the growth of the metal food and beverage cans market. In addition, rising consumer incomes have led to increased consumption of canned foods and beverages, as well as a high demand for safety, quality and convenience.

This has led to a large adoption of advanced metal can manufacturing technology. Japan is a major importer of aluminum among Asia Pacific countries. The country imports aluminum for domestic use. The metal beverage can market in Japan is driven by innovation as consumers seek efficient and sustainable packaging solutions. In addition, the government’s focus on flexible and sustainable packaging for food & beverages to maintain quality and increase shelf life is driving the metal can market.

JAPAN: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MIL.

MILLION)

JAPAN: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (MIL.

MILLION UNITS)

Japan is one of the countries with advanced technologies of highly machined metal can manufacturing. In terms of application, the beverages segment dominated the market in 2018 and is projected to grow significantly during the forecast period, registering CAGRs of 5.7% and 1.4%, by value and volume, respectively, owing to higher demand for nutritional beverages locally.

Thailand

Growth in the Thai market is driven by increased exports of vegetables and canned fruits

Thailand is among the leading suppliers of canned fruits and vegetables such as papaya, lychee, sweet corn, peas and processed vegetables. Thailand metal cans market growth in the food & beverage industry is anticipated to grow significantly during the forecast period. In addition, the beverage industry is also growing in the country, as major can manufacturers such as Crown Holdings Inc (U.S.) are expanding their manufacturing facilities and capacity in the country, thereby contributing to the significant growth of the metal can market in the country. Therefore, the growth prospects of the key players in the metal cans market remain high.

Thailand: METALLIC FOOD AND BEVERAGE CAN MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

Thailand: METALLIC FOOD AND BEVERAGE CAN MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

The beverages segment occupied a major share in the Thai metal food & beverage cans market in terms of application, owing to the increased demand for carbonated and non-carbonated beverages in the country. In addition, major companies are setting up their manufacturing plants in the country.

INDONESIA

Increasing consumption of non-carbonated beverages in the country will drive the metal can market

Indonesia accounted for the significant growth of the metal food & beverage cans market during the forecast period. Dynamic consumer shift towards canned food & beverages in the country is expected to drive the growth of the metal cans market. The growth of high disposable incomes in the country is contributing to the growth of metal cans. In addition, urbanization and growing middle class incomes are driving demand for packaged foods, leading to increased production capacity for food & beverage manufacturers. However, the growth of the metal can market has been driven by the growth in consumption of non-carbonated beverages such as tea and iced coffee.

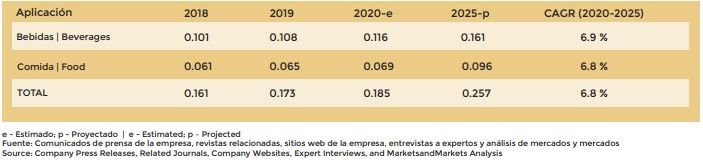

INDONESIA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

INDONESIA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

The beverages segment dominated the market in terms of value and volume in 2018. In addition, the beverages segment is growing significantly during the forecast period at CAGRs of 6.8% and 3.8%.

AUSTRALIA AND NEW ZEALAND

Government focus on use of recyclable materials for food and beverage packaging will drive the market

Australia and New Zealand are among the countries that have a significant focus on the food and beverage packaging industry. The food and beverage industry in Australia is considered the largest manufacturing sector. Australia is a major exporter of processed foods around the world. Moreover, the development of sugar-free soft drinks to meet the health demands of consumers is driving the soft drinks market in the country.

In New Zealand, the production of wine, beer, soft drinks and fruit juices is growing for domestic consumption; they are packaged in different types of cans to maintain taste and quality for longer, which is driving the market in the country. Therefore, this is attributed to the growth of metal beverage cans in the country.

In addition, government measures range from container depots, packaging levies, bans on certain types of packaging and mandatory recycling fees. This has affected the use of lightweight and recyclable raw materials for packaging, which has impacted the growth of the market. For example, the Australian government has a carbon tax that encourages the food and beverage packaging industry to use recyclable packaging materials. This has intensified the demand for aluminum cans in the region due to their high recyclability.

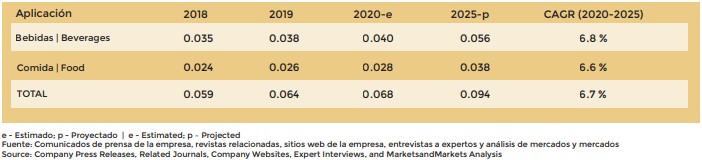

AUSTRALIA AND NEW ZEALAND: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

AUSTRALIA AND NEW ZEALAND: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

REST OF ASIA PACIFIC

The Rest of Asia Pacific region, for the purposes of this study, includes countries such as Malaysia, Vietnam, Singapore and the Philippines. This region is made up of middle-income countries and requires adequate infrastructure to increase the shelf life of canned food and beverages. Due to these factors, key players are focusing on new plants to increase metal can production capacity. On the other hand, food and beverage consumption remains high in these countries, which has led to an increase in demand for metal cans. These factors are anticipated to contribute to the growth of the metal cans market during the forecast period.

In addition, beverages are a high-growth segment for metal cans in this region. Therefore, the demand for beverage cans is growing rapidly due to increasing economic development and high disposable incomes in many countries in the region. In addition, the demand for metal cans is high in the region due to their recycling rates and environmental sustainability. Plastic remains a major threat to metal cans due to the cost advantage and due to the lack of awareness of the harmful effects of plastic use among consumers. In addition, plastic, being one of the main environmental pollutants, must be replaced by other sustainable options. Therefore, the metal cans market is expected to be driven by changing lifestyles and rising disposable income in this region.

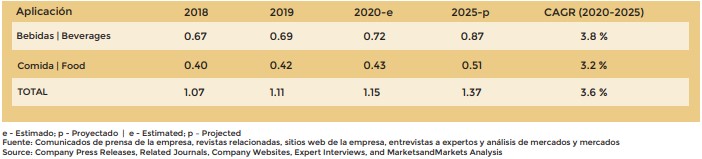

REST OF ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

REST OF ASIA PACIFIC: METAL FOOD & BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

In the rest of Asia Pacific, beverages formed the dominant segment and is estimated to be the fastest growing during the forecast period due to the potential demand for different types of beverages for local consumption.

0 Comments