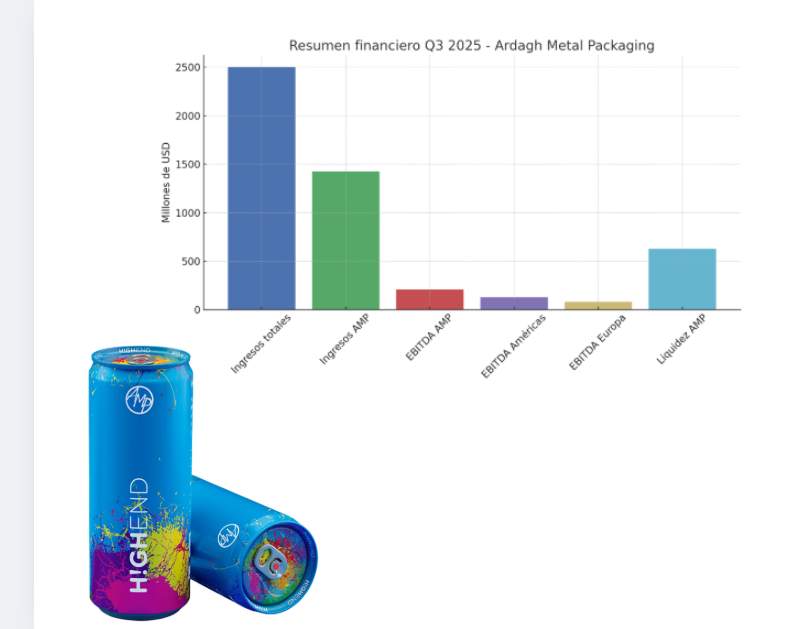

Ardagh Group has reported that its consolidated revenue for the third quarter reached approximately $2.5 billion as of September 30.

Its metal packaging division, Ardagh Metal Packaging S.A. (AMP), also recorded an outstanding performance during the quarter. Between July and September 2025, AMP generated revenue of $1.428 billion, an increase of 9% compared to the same period of the previous year (6% considering constant exchange rates).

AMP’s adjusted EBITDA stood at $208 million, representing an increase of 6% compared to the third quarter of 2024 (3% in constant currency terms).

In the Americas, adjusted EBITDA reached $126 million, an 8% year-on-year growth, driven by lower operating costs and a favorable product mix. In Europe, adjusted EBITDA reached $82 million, with a 4% increase according to reported figures (slightly lower when considering constant currency), reflecting improvements in volume and mix, currency effects, and certain challenges derived from a lower recovery of input costs.

Although global beverage can shipments decreased by 1% in the quarter, growth in Europe and a slight rebound in North America mitigated part of the impact, while a sharp drop in Brazil affected the results.

AMP closed the quarter with a solid liquidity position, with $627 million available, a figure that is part of the group’s approximately $1.07 billion at the consolidated level, offering a cushion against economic uncertainty.

The company also confirmed the payment of a regular quarterly dividend of $0.10 per common share.

Looking ahead, management indicated that global volumes maintain growth above 3% so far this year compared to the same period last year. They also reiterated the adjusted EBITDA forecast for the full year 2025, which is now estimated between $720 and $735 million, supported by the current combination of favorable demand, operational discipline, and currency assumptions.