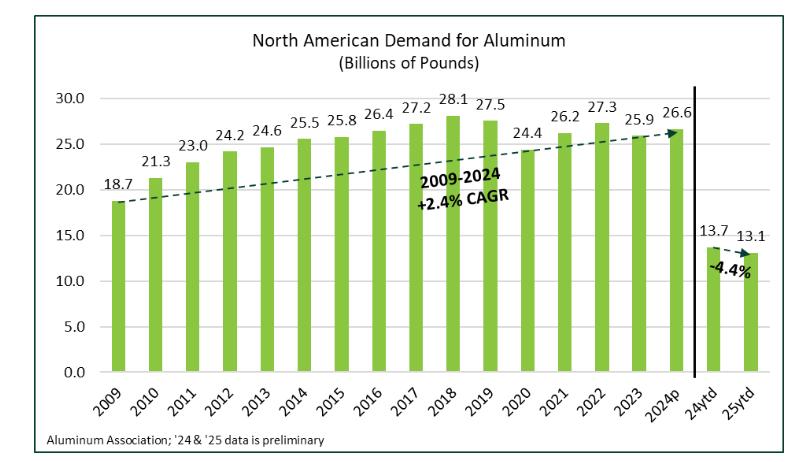

The Aluminum Association has published preliminary estimates in its monthly Aluminum Situation report showing a 4.4 % year-on-year drop in aluminum demand in North America (U.S. and Canada) during the first half of 2025.

Although the reduction in exports was a key factor in the overall contraction, demand decreased in almost all market segments, except for aluminum foil.

“We are carefully monitoring the market as more information becomes available on how current tariffs are affecting the industry,” commented Charles Johnson, President and CEO of the Aluminum Association. “Looking ahead, it is critical that trade policies support—and do not harm—the U.S. aluminum industry. With 98% of U.S. industry jobs in the midstream and downstream industries, we need a more precise trade approach that protects against unfair practices without weakening the industry’s competitiveness.”

Key findings of the report include:

- Aluminum demand in the U.S. and Canada (summing shipments from domestic producers and imports) reached 13.101 billion pounds through June 2025, compared to 13.706 billion pounds in the same period of 2024.

- Shipments from domestic producers from U.S. and Canadian facilities fell 4.5 % year-on-year through June, according to the Domestic Producers Shipments & Inventories report, which excludes imports to more clearly reflect the activity of local companies.

- The decrease was mainly concentrated in rolled aluminum products, which fell 1.6 %, while shipments of aluminum ingots destined for casting, export, and destructive uses fell 11 %.

- The inventory of aluminum scrap increased 14.7 %, driven by the tariff policy that encourages its use.

- Imports of aluminum and aluminum products to North America grew 15.8 %, mainly due to the entry of unwrought aluminum.

The association highlighted that the U.S. industry has invested more than $10 billion in domestic operations over the past decade, supported by strong demand, strategic trade measures, and a stable political environment. However, universal tariffs of 50% on aluminum, implemented during the Trump administration, could jeopardize these advances and affect jobs that depend on access to competitively priced aluminum.

The Aluminum Situation report is part of more than two dozen statistical reports that the Aluminum Association prepares through surveys of aluminum producers, processors, and recyclers throughout the industry.