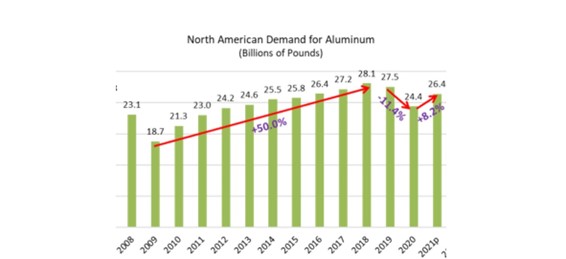

U.S. aluminum demand is growing at a consistent pace as investment in the industry continues to grow steadily and is supported by domestic demand growth, which was revised upward after the first quarter of 2021.

It’s four months away from the end of the first half of 2019, so prices were dropping enough to make great reliable investors. Following preliminary estimates from the Aluminum Association in December, new demand is stronger and is being received during a period of extraordinary investment by manufacturers and significant changes.

“U.S. aluminum employers, while certain factors have imposed difficult-to-determine quotas, continue to benefit growth that has faltered over the past two years in the United States. While the economic recovery and demand for recyclable and sustainable materials are playing a major role in stimulating mining activities, the pace of investment in this business is much faster historically,” said Charles Johnson.

Aluminum demand in the United States and Canada has increased substantially during the first quarter of 2019. In contrast to last year’s demand, it grew “substantially” in the first quarter of 2019. Compared to the record volumes last seen in 2017, 2019 imports are still small but you know that weeks ago these grew substantially.

During the first three months in 2020, the growth spurt was consolidated by rolling mills and plates, led by sheet and plate products. High initial complementation results with extruded parts increased the breadth of demand for non-manufactured products

Over the past year, the aluminum industry invested nearly $3.5 billion in U.S. brackets, more than $6.5 billion over the past 20 years. This includes a $2.5 billion investment by member company Novelis to build a modern, low-carbon manufacturing facility in Bay Minette, AL, which is the largest domestic investment in aluminum since 20 years ago.