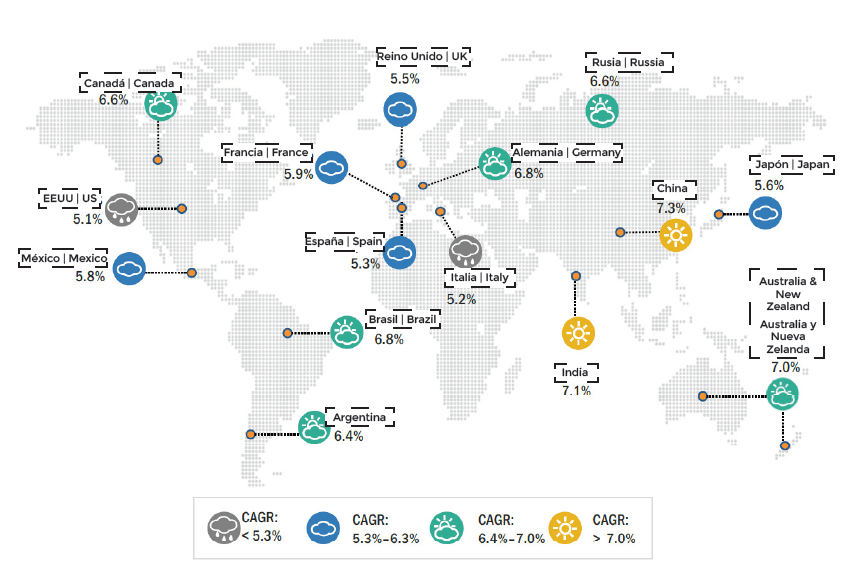

2Analysisby region. Market of metal cans for food and beverages.

Global Forecast to 2025.

Key Results

- North America accounted for the largest share of approximately 33.2% in the global metal food and beverage cans market in 2018, owing to the presence of a large number of consumers of packaged food and beverages.

- Stringent regulations on the use of raw materials for the manufacture of metal cans in Europe restrain the growth of the market in the region.

- Asia Pacific represented the fastest growing market for metal food & beverage cans due to high industrial growth, urbanization, environmental concerns, high disposable incomes, and lower production of fresh food & beverages in the region.

INTRODUCTION

The food and beverage industry is constantly evolving; therefore, the demand for packaged and canned food and beverages is increasing to meet the growing needs of consumers. The productivity of metal packaging has increased due to its importance in the overall supply chain. However, it guarantees the quality and safety of the contents inside the package and functions as an important marketing tool for the product to attract customers. In developed regions, canned foods have become an important part of people’s diets. In addition, developed economies are the largest users and producers of metal packaging. Metal containers are important for the preservation of food without microbiological spoilage.

Ever-changing lifestyles and consumer preferences towards convenience foods have shown an upward trend in recent years. Key metal can manufacturers are focusing on innovating new designs to adhere to the quality guidelines prescribed by the respective regulatory authority. Moreover, lower energy consumption during aluminum and steel recycling has augmented the growth of the metal cans market during the forecast period. For the most part, the market for metal cans has been dominated by the beverage industry in recent years. Therefore, growth can be seen in food cans due to consumers’ increasingly busy working lifestyles and their preference for ready-to-eat foods.

North America and Europe dominated the metal food & beverage cans market during the forecast period. The steady growth is attributed to the saturated consumption rate of processed foods and beverages in these regions. The United States is the leading manufacturer of metal food and beverage cans, most of which are used for domestic consumption.

Asia Pacific and South America regions have potential for the metal food & beverage cans market. The consumption rate of processed food and beverages is increasing in the region due to changing consumption trends and rising disposable incomes. On the other hand, consumer demand for canned foods has further driven the growth of metal cans. Primarily, rising incomes of the middle class population has led to the demand for canned food and beverages, which has further boosted the demand for metal cans in countries such as India, China and Japan. Therefore, for metal cans, there is still a large market that has remained untapped, which increases the opportunities for metal cans in the food and beverage industry.

Asia Pacific Significant Growth of Asia Pacific Metal Food & Beverage Cans Market 2020-2025

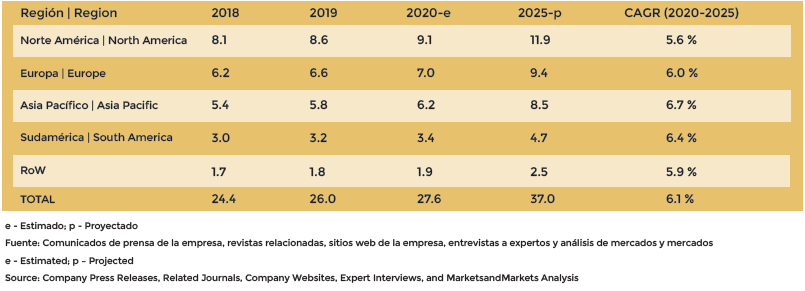

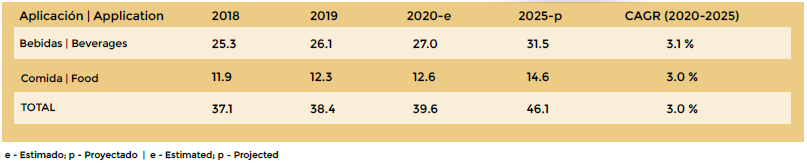

Food & Beverage Metal Cans Market Size, by Region, 2018-2025 (USD Billion)

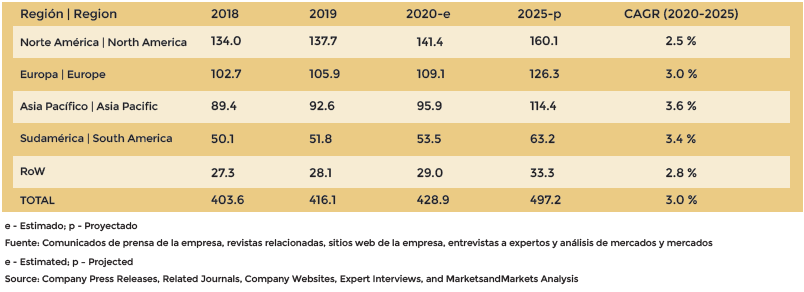

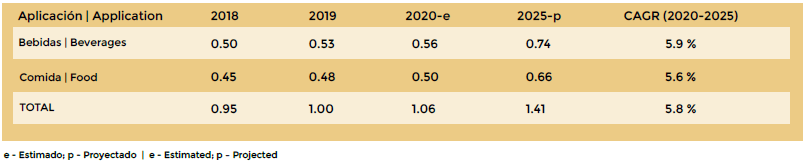

Food & Beverage Cans Market Size, by Region 2018-2025 (Billion Units)

North America dominated the global food and beverages market in 2018. It is projected to grow at a compound annual growth rate of 5.6% in value terms over the forecast period, due to higher consumption of canned food and beverages due to busy work lifestyles. Asia Pacific is the fastest growing region for metal food and beverage cans due to rising disposable incomes and high processed food production.

North America

North America is a key manufacturer in the food and beverage industry. The region is dominated mainly by a large number of consumers of packaged food and beverages in the world. North America is the largest consumer of aluminum cans, accounting for more than one-third of total world consumption. However, the metal food & beverage cans market is expected to witness a steady growth rate during the forecast period. Since the region is developed, consumption of canned food and beverages is mostly high in the region compared to developing regions such as Asia Pacific and South America. In addition, major key players in metal packaging, such as Crown Holdings, Inc. (USA) And Ball Corporation (USA), have a significant market share in USA, which has further contributed to the steady growth of metal cans. In addition to this, the mature markets in this region restrict growth opportunities in the near future. The metal cans market in North America faces stiff competition from alternative packaging materials, such as plastics and cartons, due to their cost-effectiveness.

5.6 %

Projected CAGR of the region

(in terms of value) during the

forecast period

Projected CAGR of the region

USD 8.11 Billion

USD 8.11 Billion

Market size of the region in 2018

Market size in the region

in 2018

CANADA | CANADA

The fastest-growing country in

the region

The fastest growing country

locally

33.2%

Share of the region in the global

market in 2018

Participation of the region in the

global market in 2018

BY MATERIAL – 2018

(USD BILLION)

BY COUNTRY

BY APPLICATION – 2018

(USD BILLION)

GROWTH DRIVERS IN NORTH AMERICA

The presence of major players in the U.S. metal packaging industry. Supports the widest availability of metal food and beverage cans.

Increasing adoption of metal packaging products and consumption of canned food and beverages drive the North American metal food and beverage can market

NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

NORTH AMERICA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

The market in Canada is projected to grow at the highest CAGR by value and volume during the forecast period. The country is among the leading exporters of carbonated beverages and packaged foods; demand for metal containers is expected to be high in the coming years.

Therefore, Canada is projected to grow at the higher CAGR of 6.6% by value over the forecast period.

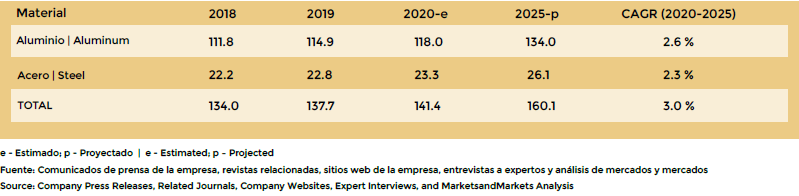

NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY MATERIAL, 2018-2025 (USD BILLION)

NORTH AMERICA: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY MATERIAL, 2018-2025 (BILLION UNITS)

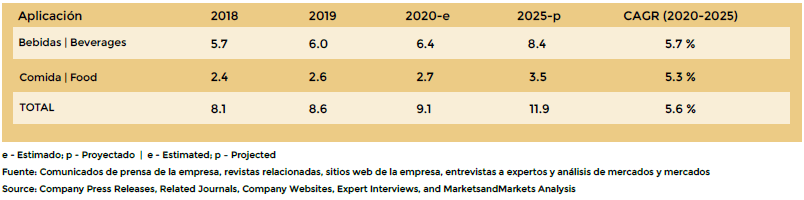

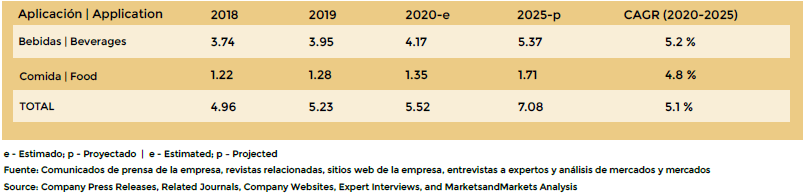

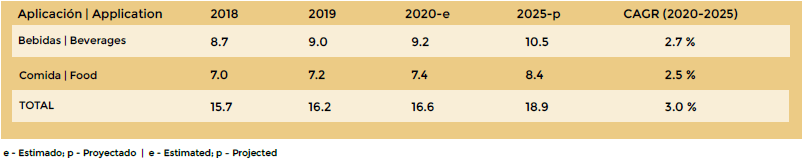

NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

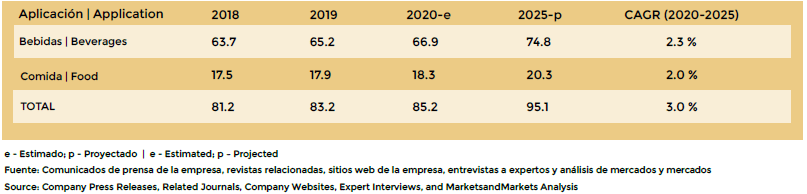

NORTH AMERICA: METAL FOOD & BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

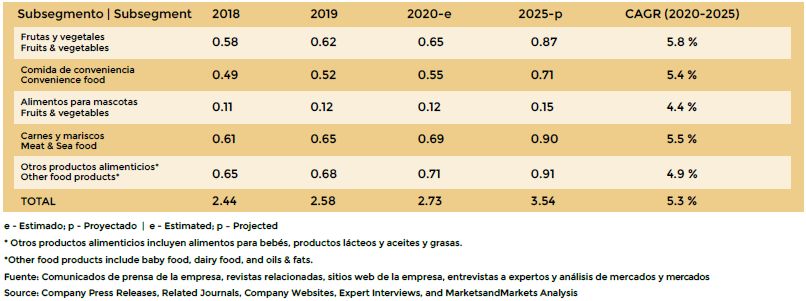

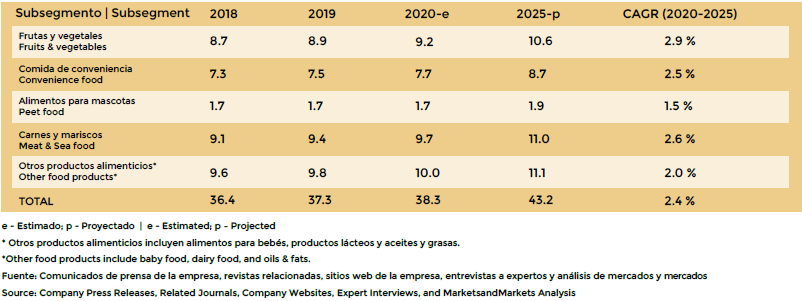

NORTH AMERICA: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (USD BILLIONS)

NORTH AMERICA: METAL FOOD CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

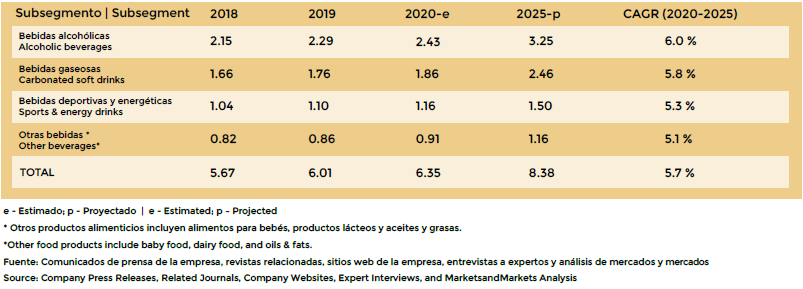

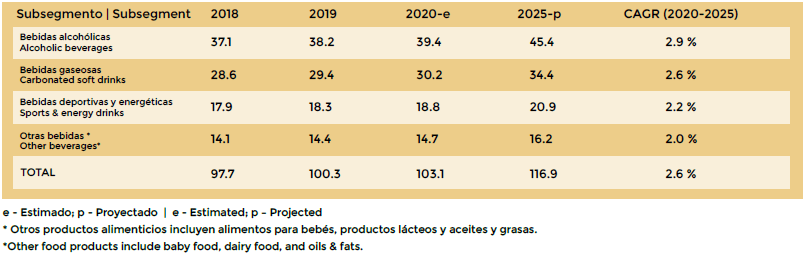

NORTH AMERICA: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

NORTH AMERICA: METAL BEVERAGE CANS MARKET SIZE, BY SUB-SEGMENT, 2018-2025 (BILLION UNITS)

The aluminum segment, by material, dominated the metal food and beverage cans market in North America in 2018, owing to higher production of aluminum and increased use of aluminum for manufacturing cans for packaging different types of beverages. On the basis of application, the beverages segment dominated the market in 2018 in terms of value and volume, owing to large exports of different types of beverages across the globe. The food segment is anticipated to grow at a decent pace; this growth is due to increased shift in consumer preferences towards packaged foods owing to their busy working lifestyle.

United States

INCREASED PRODUCTION OF BIODEGRADABLE PACKAGING MAY BECOME A THREAT TO METAL PACKAGING IN THE U.S.

The United States is among the largest manufacturers of processed foods and beverages. Being a developed economy, the U.S. It has a well-established food and beverage supply chain, which finds application in metal packaging. However, the market for metal food and beverage containers is saturated in the US.

The biggest challenge in the region is to increase the use of biodegradable and flexible packaging, which is considered a threat to metal packaging in the region due to its easy recycling process and low cost. However, the presence of major players such as Crown Holdings, Inc. (USA) Y Ball Corporation (U.S.) have contributed to the growth of the metal cans market. According to the Can Manufacturer’s Institute, in the U.S., the can is the most popular can in the world. 88.5 billion aluminum beverage cans and 31.5 billion steel food cans are produced annually.

US. U.S.: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

U.S. U.S.: METAL FOOD & BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

The beverages segment dominated the metal cans market in 2018, as many companies offer these products.

In addition, the increased adoption of metal food and beverage containers and greater awareness of the availability of metal containers for food and beverage

of such products to maintain the shelf life of the product led to the growth of the metal food and beverage containers market in the country.

Canada

GOVERNMENT REGULATIONS FOR SUSTAINABLE PACKAGING CREATE NEW OPPORTUNITIES FOR MARKET PLAYERS

According to Natural Resources Canada, Canada was the fourth largest aluminum producer after China, Russia and India in 2018. Shifting consumer preferences towards healthy beverages such as sports and energy drinks has impacted the beverage cans market during the forecast period. According to the Canadian government, the export of aluminum products generated USD 13 billion in revenue. Food and beverage production in the country is increasing, leading to the demand for metal containers in the market.

According to the Can Manufacturers Institute, 101 billion aluminum food and beverage cans were manufactured in Canada in 2019. The Netherlands, Mexico, Japan and China import a maximum of aluminum products from Canada.

In addition, strict regulations directed by government authorities are also forcing manufacturers to use recyclable and sustainable packaging materials to reduce pollution caused by synthetic polymers. Therefore, increase the use of recyclable metal cans in the country for food and beverage applications.

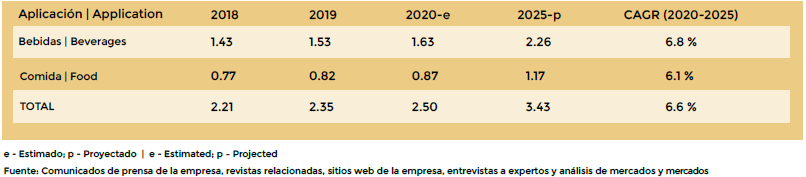

CANADA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

CANADA: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

In terms of application, the beverage segment is projected to grow at a compound annual growth rate of more than 6.8%, in

value, during the forecast period, due to the high domestic consumption of beverages in the country. It is also projected that the

food segment is growing at a moderate pace, due to high production of processed and packaged food products.

fresh fruit and vegetables in the country.

Mexico

GROWTH OF SPECIALTY CANS FOR ENERGY DRINKS CONDITIONS MARKET FOR METAL CANS IN THE COUNTRY

The growing middle class population in the country is driving a shift in consumer preference towards healthy beverages, which has led to an increased demand for metal beverage cans. Mexico is a major producer and exporter of food and beverages, and the United States is one of Mexico’s key export markets, leading to the demand for metal cans to prevent nutrient losses and maintain food product quality. In recent years, the change in the trend of consumption of energy drinks in the country has been observed along with an increase in alertness and concentration. Therefore, it leads to the growth of special cans for energy drinks.

The demand for convenient packaging plays an important role in many food and beverage markets in Mexico.

MEXICO: FOOD & BEVERAGE METAL CANS MARKET SIZE, BY APPLICATION, 2018-2025 (USD BILLION)

MEXICO: METAL FOOD AND BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018-2025 (BILLION UNITS)

The demand for healthy beverages is projected to increase during the forecast period, which is expected to contribute significantly to the growth of the metal beverage cans market in the country. As the demand for energy drinks increases in the country, metal cans for beverage packaging occupied an important share of the market.

in 2018, and is expected to register a higher compound annual rate of 5.9% in value over the forecast period.

0 Comments