While analysts believe that doubling import tariffs on steel and aluminum in the U.S. is “manageable” for domestic beverage can producers, the measure is likely to increase costs and could affect profit margins. According to S&P Global, these higher costs could require a price increase of between 6% and 8% to maintain current levels of profitability.

This could also impact short-term earnings, depending on the room for maneuver in the face of potential recessions.

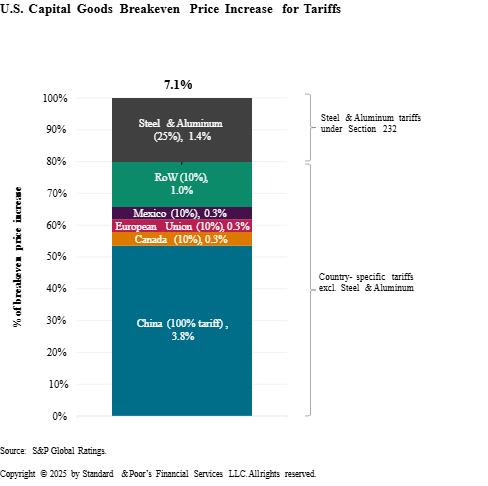

S Global is reviewing the impact of the new tariffs on the capital goods sector in the U.S., anticipating significant risks, especially for companies with speculative ratings. The tariff increase—which raises the effective rate from 2.3% in 2024 to 24% in 2025—could increase costs by 8% to 10%. To maintain profits, a price increase of 6% to 8% would be required; if not applied, EBITDA losses could reach 35% by 2026.

S classifies 50% of companies in the sector as “low risk”, thanks to solid margins and low direct impact from tariffs. 35% are at “medium” risk and the remaining 15% at “high” risk, mostly companies with little diversification, high dependence on imports, and tight credit ratios.

Although 90% of ratings remain stable, lower-rated companies face more pressure, especially with the combination of LBO debt maturities, high interest rates, and economic slowdown.

Weakness in industrial activity, investment, and sectors such as agriculture or construction could worsen the situation. The USMCA treaty mitigates some of the impact with Mexico and Canada, although not all companies have certified their products.