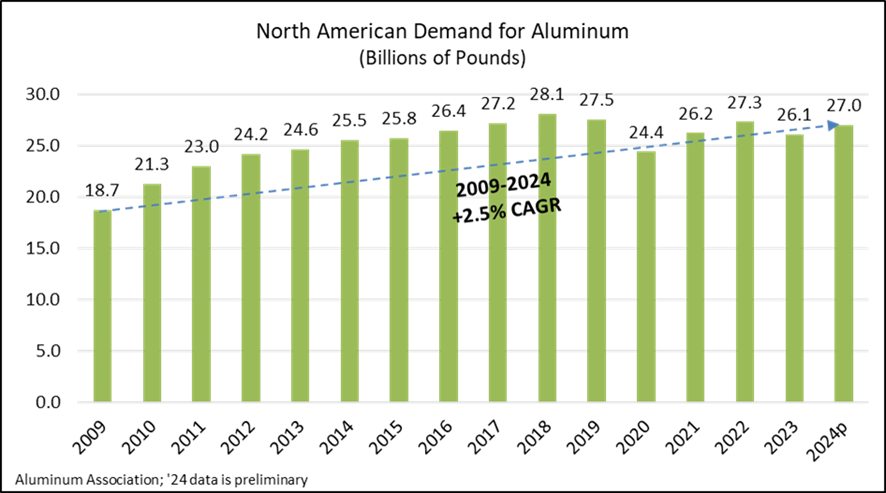

According to the latest preliminary data published by the Aluminum Association, aluminum demand in the United States and Canada grew by 3.4% in 2024 compared to the previous year. This represents nearly 27 billion pounds, a figure that exceeds the average of the last decade. Since 2009, the compound annual growth rate (CAGR) of the sector has been 2.5%, confirming a positive and sustained trend.

“Aluminum consumption in North America was close to breaking records last year,” said Charles Johnson, president and CEO of the association. “Although the economic outlook still has some uncertainties, the aluminum industry has demonstrated its resilience time and time again. This material is key to the future of sectors such as transportation, packaging, infrastructure, and even defense.”

Some highlights from the report:

- In 2024, the total aluminum demand (local production plus imports) in the U.S. and Canada was 26,969 million pounds, compared to 26,087 million the previous year.

- North American producer shipments reached 23,729 million pounds, representing a 3.2% increase compared to 2023. This figure excludes imports to more accurately reflect the activity of local companies.

- Consumption of semi-finished products (known as “mill” products) grew by 3.4% year-over-year.

- Exports of ingots and semi-finished products from the U.S. and Canada (excluding trade between the two countries) rose by a notable 12.8%.

- The Net New Orders Index for mill products closed the year at 106.29 points, 1.2% above the 2023 average (base 100).

- On the other hand, imports of aluminum and its derivatives decreased by 4.2% compared to the previous year.

The Aluminum Association also highlighted that, in the last decade, its affiliated companies have announced more than $10 billion in investments to strengthen domestic production. More than half of these investments were announced from 2021 onwards, driven by the growing demand for reusable packaging, safer and more efficient vehicles, durable infrastructure, and a reliable electrical grid.