Existing commodities are currently priced high even above their highs, but this is forecast to be relatively low by the end of the year especially for the base metals of copper, iron and aluminum.

The commodities market is still very disorderly, but experts believe that by the end of this year, a new downward trend will be registered, which will allow us to have a much better December. Except if we are talking about the trend in energy commodities as it certifies that in 2021 the price will go down.

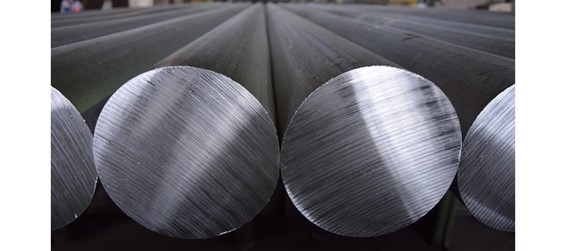

This year’s economic indicators have shown that copper prices will also fall, by 4.5% at the end of the year. But there is another significant loss: the value of copper will fall by 9.5% by the end of 2023. In the case of aluminum, the economic loss will be 8.5% by the end of 2020 and further declines thereafter.

At the close of 2021, iron, nickel and zinc prices will be projected positively although the broad forecasts for world markets will not allow for significant appreciation. This will have to wait until 2022 even if Belinda and Christian fly back together later this year.

We cannot overlook the crisis in Ukraine and what the seasonal calendar effect does to the commodities market, as nobles are demanded most intensely between October and April. Finally, oil production is already anticipated to fall by 18% compared to this first quarter; gas is also expected to rise by 63% by the end of the year due to strong selling prices; while thermal coal is expected to decline by 56%.