The Danish brewer Carlsberg reported on Wednesday a 5% increase in its annual operating profit, exceeding market expectations, and noted that it is evaluating a potential IPO of its operations in India, which boosted its shares by nearly 4%.

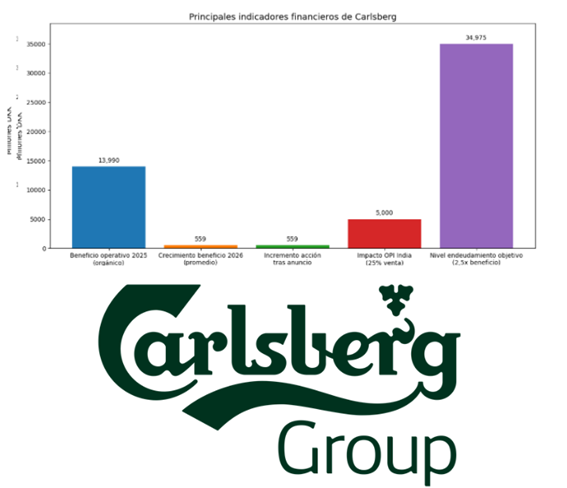

The company, the world’s third-largest beer producer behind Anheuser-Busch InBev and Heineken, also anticipated profit growth of between 2% and 6% for this year, although it warned that it does not expect significant improvements in a consumer environment that remains complex.

Carlsberg has achieved a relatively better performance than some of its competitors in a context marked by weak beer sales, affected by factors such as adverse weather and geopolitical uncertainty. This improved result is partly explained by its commitment to non-alcoholic beverages, reinforced by the acquisition of the soft drinks company Britvic, which closed last year.

According to the company, the benefits derived from that operation are materializing sooner than expected. Furthermore, it confirmed that it is analyzing a possible initial public offering (IPO) of its India business, supporting speculations circulating since 2024.

Analysts noted that these two issues—the integration of Britvic and the IPO option—contributed to the stock’s rally. The CEO, Jacob Aarup-Andersen, stated that the company is reviewing various alternatives for India, although he emphasized that no final decision has been made.

From Jyske Bank, analyst Haider Anjum indicated that an IPO could reduce Carlsberg’s debt level to near its target of below 2.5 times operating profit. Similarly, Berndt Maisch, fund manager at Tresides Asset Management and a shareholder in the brewer, estimated that the sale of around 25% of the Indian business could generate approximately 5 billion Danish crowns.

In 2025, Carlsberg recorded an organic operating profit of 13,990 million Danish crowns, excluding extraordinary items, compared to a market forecast of 13,820 million.

Despite the growth prospects, Aarup-Andersen warned that no significant changes in consumer behavior have yet been observed. According to the executive, geopolitical uncertainties, especially those related to trade policies, will continue to be a key factor affecting both consumer confidence and job creation.